4Sale’s Used Cars Year in Review 2025

In 2025, Kuwait’s used-car market remained strong and continued to grow. Industry estimates place its value at about USD 1.65 billion, with projections reaching USD 3.48 billion by 2030. The growth reflects sustained demand for pre-owned vehicles, supported by affordability, high ownership rates, and strong population dynamics.

The market is now entering a phase of normalization. Buyers are finding more stable prices and better value. Digital marketplaces and wider supply networks are transforming how cars are bought and sold across the country.

4Sale’s 2025 Used Cars in Review presents key insights from Kuwait’s market, including the top 20 used-car brands and models by listings, the most searched brands and models on 4Sale, year-over-year changes in search interest, the distribution of cars by origin, and more.

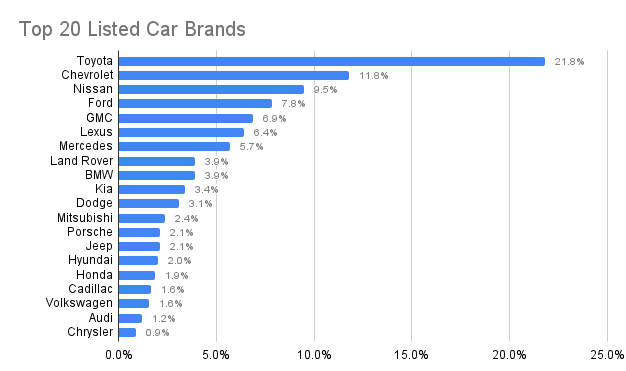

Top 20 Used Car Brands by Number of Listings

Key takeaways

- Toyota leads the market with 21.8% of all used-car listings. This share is more than double that of any other brand and reflects Toyota’s strong reputation for durability and sustained demand in Kuwait.

- Chevrolet ranks second at 11.8%, driven by strong demand for SUVs and pickup trucks.

- Nissan follows with 9.5%. American brands remain influential, with Ford holding 7.8% and GMC 6.9%, supported by continued demand for large vehicles.

- Premium brands also account for a meaningful share of listings. Lexus represents 6.4%, Mercedes 5.7%, and both BMW and Land Rover 3.9%, signaling steady interest in the luxury segment.

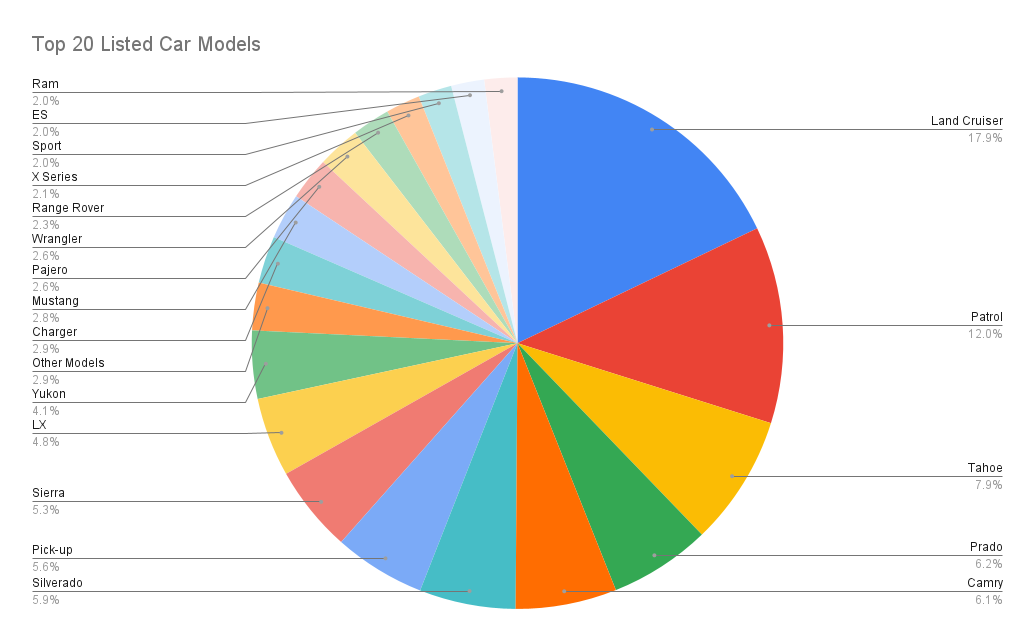

Top 20 Used Car Models by Number of Listings

Key takeaways

- Toyota Land Cruiser and Nissan Patrol dominate the market, together representing nearly 30% of all used-car listings. The Land Cruiser holds 17.9%, while the Patrol accounts for 12% confirming Kuwait’s preference for large and durable SUVs.

- Chevrolet Tahoe ranks third at 7.9%, showing continued demand for American full-size SUVs known for space and comfort.Toyota appears again in the mid-range segment, with the Prado accounting for 6.2% of listings and the Camry close behind at 6.1%.

- Pickup and truck models maintain strong activity, led by the Chevrolet Silverado at 5.9%, followed by the Nissan Pick-up at 5.6% and the GMC Sierra at 5.3%. This trend reflects sustained demand for work-oriented vehicles in Kuwait.

Top Searched Car Brands and Their YoY Growth

Key takeaways

- Haval records the strongest year-over-year growth at 42%, indicating rapidly rising interest in value-driven SUV brands.

- Hyundai follows closely with 41% growth, reflecting growing demand for reliable and competitively priced vehicles.

- MG, BMW, and Kia also show strong momentum, with growth rates of 29%, 27%, and 27%, signaling increasing interest across both mainstream and premium segments.

- Jeep and Audi post solid gains of 17% and 18%, supported by sustained demand for SUVs and premium performance brands.

- Toyota maintains steady growth at 7%, reinforcing its consistent leadership despite already high search volumes.

- Nissan and Volkswagen are the only brands showing decline, with searches down 2% and 12%, suggesting softening interest compared to last year.

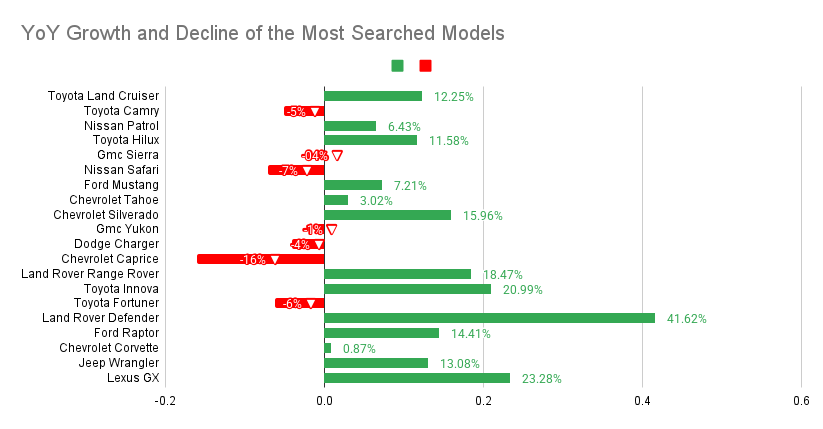

Top Searched Car Models and Their YoY Growth/Decline

Key takeaways

- The Land Rover Defender records the strongest year-over-year growth at 41.6%, signaling a sharp rise in demand for premium off-road SUVs.

- Toyota models continue to perform strongly across segments. The Innova grows by 21%, the Land Cruiser by 12.3%, and the Hilux by 11.6%, reinforcing Toyota’s broad appeal in Kuwait’s used-car market.

- Lexus GX shows solid momentum with 23.3% growth, reflecting sustained interest in premium SUVs with strong reliability and resale value.

- Chevrolet Silverado posts notable growth of 16%, highlighting continued demand for pickup trucks and work-oriented vehicles.

- Mid-range SUVs and performance models show moderate gains. Jeep Wrangler grows by 13.1%, Ford Raptor by 14.4%, and Nissan Patrol by 6.4%.

- Several models see declining interest. Chevrolet Caprice drops by 16%, while Dodge Charger, Nissan Safari, Toyota Camry, and Toyota Fortuner record smaller year-over-year declines, indicating softening demand in selected sedan and older SUV segments.

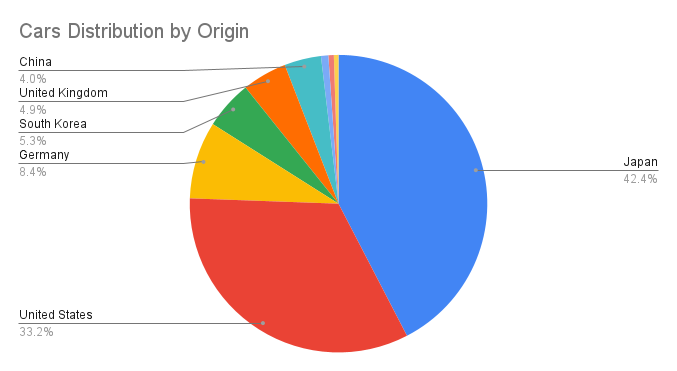

Cars Distribution by Origin

Key takeaways

- Japanese cars dominate the market with 42.4% of all used-car listings, reflecting strong trust in reliability and resale value.

- American vehicles follow with 33.2%, driven by continued demand for large SUVs and pickup trucks.

- German brands account for 8.4%, maintaining steady interest in the premium segment.

- South Korean cars represent 5.3%, supported by growing appeal in the mid-range category.

- Chinese cars now make up 4% of listings and show a growing presence in the market, signaling rising adoption of newer brands and expanding supply.

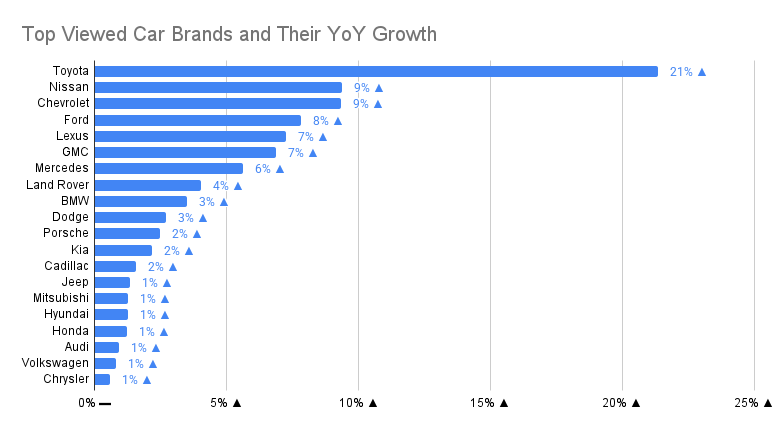

Top Viewed Car Brands and Their YoY Growth

Key takeaways

- Toyota leads by a wide margin, recording a 21% year-over-year increase in views. This reinforces its position as the most visible and consistently searched brand in Kuwait’s used-car market.

- Nissan and Chevrolet follow with 9% growth each, reflecting sustained interest across both Japanese and American brands.

- Ford posts 8% growth, supported by continued demand for pickups and SUVs.

- Premium brands show steady gains. Lexus grows by 7%, Mercedes by 6%, and Land Rover by 4%, indicating stable interest in luxury and performance segments.

- Most other brands record modest growth between 1% and 3%, signaling broad-based but incremental increases in overall market engagement.

Top Car Brands by Buyer Inquiries (CTA) and YoY Growth

Key takeaways

- Chevrolet leads buyer inquiries with 10% year-over-year growth, indicating strong buyer intent and high engagement across its listings.

- Nissan follows closely at 9%, reinforcing its position as one of the most in-demand brands among active buyers.

- Lexus, GMC, and Ford each record 7% growth, reflecting balanced demand across premium SUVs, trucks, and mainstream segments.

- Mercedes posts moderate growth at 4%, while Kia, Land Rover, and BMW each grow by 3%, showing steady interest in both value and luxury categories.

- Most remaining brands see incremental gains between 1% and 2%, signaling broad but measured growth in buyer inquiries across the market.

The Rise Of Chinese Cars in Kuwait

Chinese vehicles have moved from niche to mainstream in Kuwait’s automotive market. This shift is clearly visible in sales patterns, registration trends, and buyer behavior on 4Sale.

Chinese automakers now compete directly with Japanese, American, and European brands on volume, availability, and pricing. This signals a structural change in the market rather than a short-term trend.

This shift aligns with growing demand for modern technology and competitive pricing. A rising segment of buyers prioritizes safety features, specifications, and overall value for money. As a result, Chinese brands are becoming a more frequent consideration in the used-car market.

Final Thoughts: The Future of the Used Cars Market in Kuwait

Kuwait’s used-car market remains resilient and continues to grow. Trends observed in 2025 point to sustained momentum and further expansion.

Japanese and American brands continue to dominate, while the growing mix of listings reflects a mature and increasingly digital market. Buyers are more value-focused and research-driven, with strong emphasis on reliability, resale value, and spare-part availability.

These dynamics favor the used-car segment. It offers predictable pricing, faster transactions, and greater flexibility than the new-car market. As economic conditions evolve, used cars remain a practical and trusted choice for a broad segment of consumers.